Greater COGS with disproportionate pricing can depart your business in a deficit position if the prices are too low or alienate consumers if the worth is too high. Beginning stock refers to the value of products an organization has on hand firstly of an accounting interval. This figure represents products that have been purchased or manufactured in a previous interval however remained unsold. It serves as the place to begin for tracking stock motion throughout the present interval. After 12 months finish, Jane decides she will be ready to earn more money by improving machines B and D. She buys and makes use of 10 of elements and provides, and it takes 6 hours at 2 per hour to make the enhancements to every machine.

Free Monetary Modeling Classes

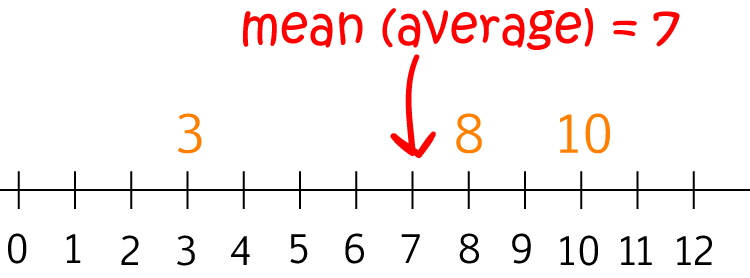

It is primarily because the common variable value of manufacturing (gray line) decreases with the rise in production initially and then starts growing with the incremental production. On the other hand, the common fastened prices (orange line) proceed to decrease significantly as the manufacturing volume will increase. The idea of common value helps decide the quantity spent per unit of an item. In accounting, the Weighted Average Value (WAC) technique of stock valuation uses a weighted average to determine the amount that goes into COGS and stock.

Maintaining observe of your price of sales is like having a monetary well being checkup for your corporation. It exhibits you where your money’s going and helps you make smarter choices. With our price of goods bought calculator, we aim that will assist you assess the entire price incurred of manufacturing and promoting goods. For extra detailed evaluation, discover our stock turnover calculator and margin calculator. The alternative between periodic and perpetual inventory systems impacts how companies handle and report stock. Every system has unique advantages and challenges, influencing operational efficiency and financial accuracy.

Purchase Of Uncooked Supplies

Common value refers back to the total value of manufacturing divided by the amount of output produced. It is a measure of a company’s efficiency in production, representing the quantity it costs a company to provide one unit of a particular good or service. The gross profit helps decide average cost of sales the portion of income that can be utilized for operating expenses (OpEx) as well as non-operating bills like curiosity expense and taxes.

Is Price Of Gross Sales The Identical As Value Of Products Sold?

Not Like COGS, operating bills (OPEX) are expenditures which are in a roundabout way tied to the production of products or services. Price of products sold (COGS) represents the direct costs of manufacturing or purchasing the merchandise a company sells, similar to materials and labor. It excludes indirect expenses, such as distribution prices and gross sales pressure costs. For most small companies, the value of gross sales is identical as direct prices – the bills immediately linked to the goods or companies you sell.

- Chatbot expertise provides substantial advantages to both your small business and your prospects.

- This concept is crucial as it helps determine the long-run worth and supply of any commodity, and hence it influences profit considerably.

- In the dynamics of any market economic system, the common price performs an instrumental position immediately concerning the principles of competitors, supply and demand, and production effectivity.

- In some cases, items can perish or turn into out of date earlier than they’re able to be offered.

What’s Included In Price Of Sales?

Fluctuations in variable costs impact the unit value and, subsequently, the typical price, making control over these prices important. Effective procurement strategies and provide chain administration can considerably cut back variable prices, which might consequently decrease the average cost. Properly, they need to know that each https://www.kelleysbookkeeping.com/ are primarily the same thing and are often used interchangeably. Each mean the identical factor as they check with the direct prices linked with producing or purchasing the products or companies that a company produces or sells during a specific accounting period.

Now, let’s see how price of gross sales is calculated when making use of the three stock value methods. In this methodology, the average cost of all bought or manufactured stock is used, whatever the buy or manufacturing date. Now, you might’ve heard of COGS, which stands for Price of Goods Bought. It’s pretty much the identical as price of gross sales, but there’s a tiny twist.